Jumbo Loan: Tailored Home Loan Solutions for High-Income Borrowers

Jumbo Loan: Tailored Home Loan Solutions for High-Income Borrowers

Blog Article

Maximizing Your Home Purchasing Possible: An Extensive Appearance at Jumbo Financing Financing Options

Browsing the intricacies of jumbo car loan financing can dramatically boost your home acquiring potential, specifically for high-value properties that exceed standard funding limitations. As you think about these variables, the inquiry stays: exactly how can you strategically placement on your own to take full benefit of these funding options while reducing threats?

Understanding Jumbo Fundings

In the world of home loan funding, jumbo car loans work as an important choice for customers looking for to buy high-value homes that exceed the conforming loan limits set by government-sponsored ventures. Usually, these limits vary by region and are figured out each year, typically mirroring the regional real estate market's dynamics. Big loans are not backed by Fannie Mae or Freddie Mac, which distinguishes them from traditional finances and introduces various underwriting requirements.

These lendings usually feature greater interest rates because of the perceived risk associated with larger finance amounts. Customers that decide for jumbo financing generally require an extra comprehensive monetary account, consisting of greater credit rating and reduced debt-to-income proportions. Additionally, big fundings can be structured as fixed-rate or adjustable-rate home mortgages, permitting consumers to choose a repayment plan that lines up with their monetary objectives.

The significance of big lendings expands past mere funding; they play an essential function in the luxury genuine estate market, making it possible for buyers to obtain buildings that represent substantial financial investments. As the landscape of home loan options develops, recognizing jumbo loans becomes essential for browsing the intricacies of high-value property acquisitions.

Eligibility Needs

To get a big car loan, borrowers need to satisfy details qualification requirements that vary from those of standard financing. One of the key criteria is a higher credit report score, commonly requiring a minimum of 700. Lenders assess creditworthiness carefully, as the enhanced financing quantities require higher risk.

Additionally, jumbo lending candidates usually need to provide proof of substantial revenue. Several lenders choose a debt-to-income proportion (DTI) of 43% or lower, although some may enable as much as 50% under particular circumstances. This makes sure consumers can handle their month-to-month repayments without monetary stress.

Moreover, significant assets or reserves are commonly needed. Lenders may request for at least 6 months' well worth of mortgage payments in fluid assets, showing the consumer's ability to cover expenditures in case of revenue disturbance.

Lastly, a larger deposit is popular for jumbo loans, with many lending institutions anticipating at the very least 20% of the purchase rate. This demand reduces danger for lenders and shows the consumer's dedication to the financial investment. Fulfilling these stringent qualification standards is vital for safeguarding a big funding and effectively browsing the premium property market.

Interest Rates and Charges

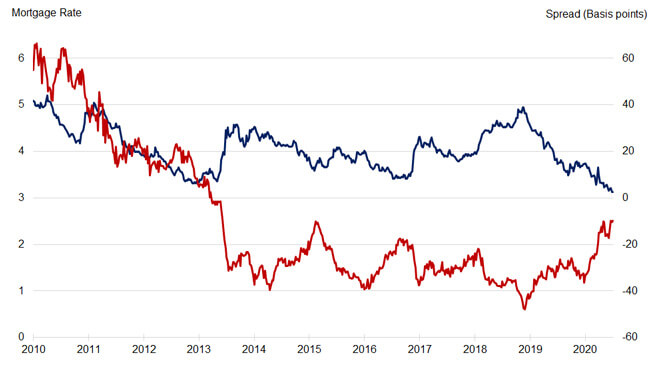

Recognizing the details of rates of interest and charges connected with big financings is crucial for possible borrowers. Unlike adjusting fundings, jumbo fundings, which go beyond the adjusting lending limitations established by Fannie Mae and Freddie Mac, normally featured higher passion prices. This rise is attributable to the regarded risk lenders handle in funding these larger fundings, as they are not backed by government-sponsored ventures.

Rate of interest can vary considerably based upon several variables, including the debtor's credit rating, the loan-to-value proportion, and market conditions. It is vital for debtors to look around, as different lending institutions might offer differing rates and terms. In addition, big fundings may entail higher charges, such as origination costs, appraisal charges, and private home loan insurance policy (PMI) if the deposit is much less than 20%.

To decrease prices, borrowers ought to very carefully evaluate the cost frameworks of various lenders, as some may provide reduced rate of interest but higher fees, while others might provide a more balanced technique. Ultimately, comprehending these parts aids borrowers make educated choices and maximize their funding options when acquiring deluxe buildings.

Benefits of Jumbo Fundings

Jumbo car loans supply significant benefits for buyers looking for to purchase high-value residential properties. One of the primary benefits is that they offer accessibility to funding that surpasses the adapting finance limitations set by the Federal Real Estate Financing Agency (FHFA) This allows buyers to secure bigger funding quantities, making it possible to acquire lavish homes or homes in highly desired places.

Furthermore, big finances commonly come with affordable rate of interest, specifically for consumers with solid credit history profiles. This can lead to considerable financial savings over the life of the funding. Additionally, big lendings typically permit a selection of car loan terms and structures, offering versatility to customize the funding to fit specific long-lasting objectives and monetary scenarios.

Another trick benefit is the potential for reduced deposit needs, depending upon the lending click here for more info institution and borrower certifications. This makes it possible for buyers to get in the premium property market without needing to commit a considerable ahead of time funding.

Lastly, jumbo fundings can provide the chance for greater cash-out refinances, which can be beneficial for property owners seeking to use their equity for significant expenses or various other investments - jumbo loan. Overall, jumbo finances can be a reliable tool for those navigating the upper echelons of the real estate market

Tips for Securing Financing

Securing funding for a jumbo lending needs careful prep work and a calculated strategy, particularly given the distinct qualities of these high-value mortgages. Begin by evaluating your financial health; a durable credit history, generally over 700, is critical. Lenders view this as an indication of integrity, which is essential for jumbo finances that surpass conforming funding restrictions.

Engaging with investigate this site a home mortgage broker experienced in jumbo fundings can provide valuable understandings and access to a broader array of lending options. By following these tips, you can enhance your opportunities of successfully protecting funding for your jumbo financing.

Verdict

Finally, big loans offer unique advantages for purchasers looking for high-value buildings, provided they satisfy specific qualification requirements. With demands such as a strong credit rating, low debt-to-income proportion, and considerable deposits, prospective homeowners can access luxury realty opportunities. By contrasting rate of interest and teaming up with knowledgeable home loan brokers, people can improve their home acquiring possible and make informed monetary choices in the affordable property market.

Browsing the intricacies of jumbo loan funding can considerably enhance your Read Full Report home purchasing prospective, especially for high-value buildings that exceed standard car loan limitations.In the realm of home mortgage financing, jumbo finances serve as a critical choice for debtors looking for to buy high-value residential or commercial properties that exceed the conforming lending restrictions set by government-sponsored enterprises. Unlike adhering lendings, big car loans, which go beyond the adhering financing restrictions established by Fannie Mae and Freddie Mac, commonly come with greater passion rates. Jumbo car loans usually permit for a range of loan terms and structures, providing versatility to customize the funding to fit private economic scenarios and long-term objectives.

Lenders view this as an indication of reliability, which is important for jumbo lendings that exceed adapting finance restrictions. (jumbo loan)

Report this page